Average Union Plumber Pension

The average union plumber pension is a retirement plan that is available to union members who are plumbers. Plumbers who are members of a union can benefit from a pension plan that provides them with a secure financial future. The pension plan can provide a fixed monthly payment to the union plumber upon retirement, or it may pay a lump sum at the end of their careers. The amount of the pension depends on the length of employment and the agreement between the union and the employer. Union plumbers can also take advantage of other benefits such as health insurance, life insurance, and disability coverage. The average union plumber pension can be a great way to ensure financial security in retirement.

Overview of Union Plumber Pensions

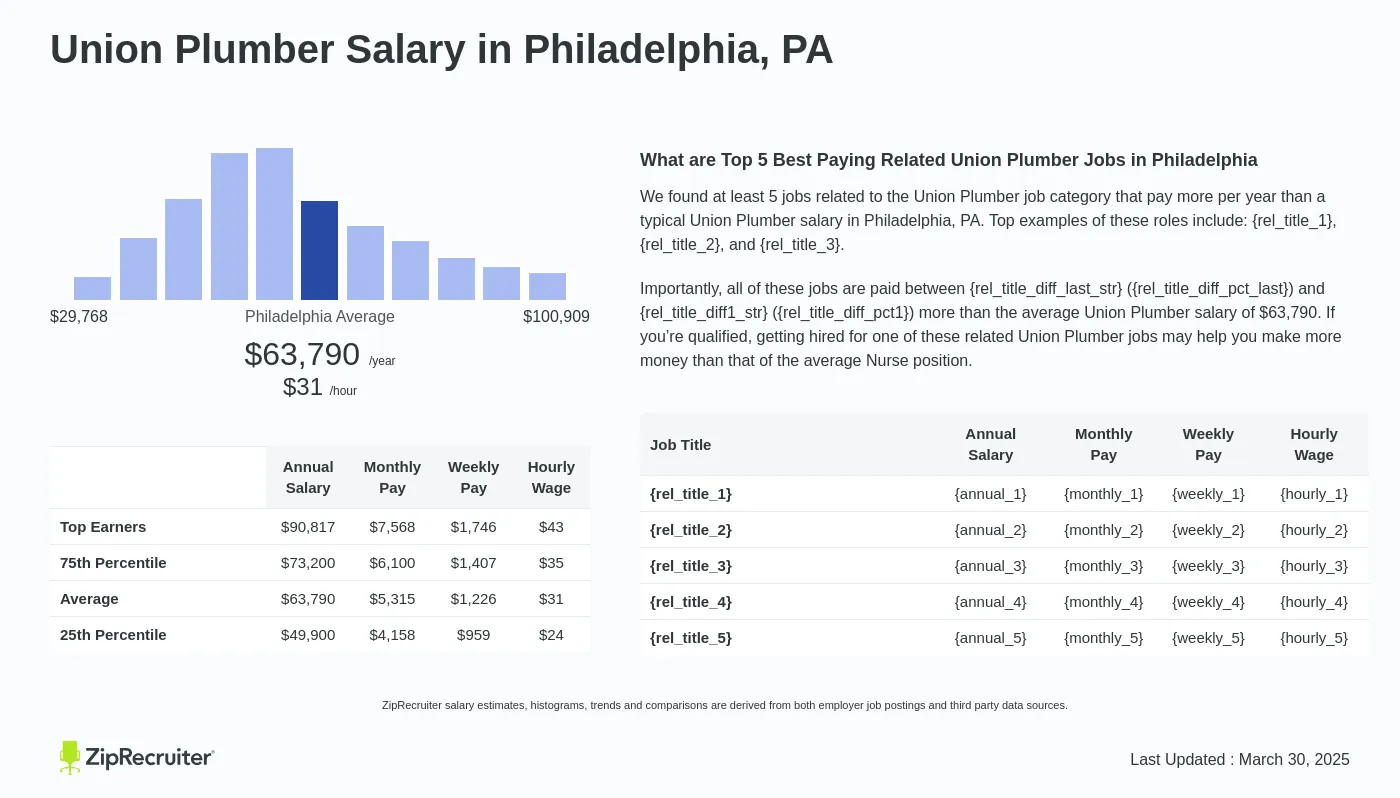

The importance of union plumber pensions cannot be overstated. The retirement security of union plumbers is a crucial factor that ensures the continued success of the trade. But, how much do union plumbers typically receive upon retirement? On average, union plumbers receive a pension of approximately $19,000 annually. This number may vary depending on the type of union, contract negotiations, and other factors, but it is a good representation of the overall pension amount.

In addition to the average pension amount, union plumbers may also receive additional benefits such as medical and dental coverage, life insurance, and disability payments. These benefits are usually negotiated by the union and can provide important financial and healthcare security to retired union plumbers.

It is also important to note that some union plumbers may not be eligible for Social Security benefits. Due to the nature of their employment, union plumbers may not have the required number of years of service to qualify for Social Security benefits. However, in some cases, union plumbers may be able to join other retirement plans to supplement their union pension.

Overall, union plumbers have the potential to receive a substantial pension upon retirement. Although the average pension amount is approximately $19,000 annually, union plumbers may receive additional benefits such as medical and dental coverage, life insurance, and disability payments. Furthermore, some union plumbers may not be eligible for Social Security benefits, but they may be able to join other retirement plans to supplement their union pension.

Typical Retirement Benefits for Union Plumbers

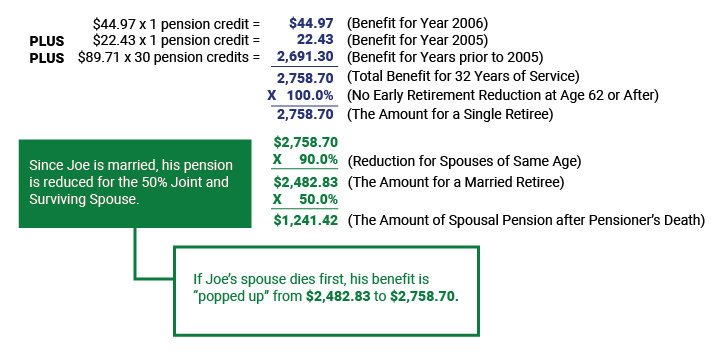

Retirement planning is a crucial part of securing your financial future. For many union plumbers, understanding the average union plumber’s pension can help them plan for their retirement. Union plumbers typically receive retirement benefits through a pension plan typically funded by a trust created by employers and the union. These pension plans provide a guaranteed income for life upon retirement and usually include a fixed amount for each year worked.

Union plumbers may also be eligible for additional retirement benefits such as early retirement, disability, and survivor benefits. Early retirement is typically available to union plumbers who have reached a certain age and have worked a certain number of years. Disability benefits are available to union plumbers who become incapacitated and are unable to work. Survivor benefits are available to the families of union plumbers who have died while employed.

Understanding the typical retirement benefits offered to union plumbers can help them plan for their retirement. With the right planning, union plumbers can secure a stable financial future and enjoy their retirement years with confidence.

Factors Affecting the Average Union Plumber Pension

Union plumbers have access to a variety of retirement benefits that can help them build a secure and comfortable financial future. In general, the average union plumber’s pension is determined by several factors, including the size of the pension plan, the type of plan, the union’s contribution, and the worker’s years of service.

The size of the pension plan is important because larger plans typically offer higher pension benefits. The type of plan also plays a role in how much money the union plumber can receive. For example, defined benefit plans, which guarantee a pre-determined amount of money, are more generous than defined contribution plans, which allow workers to choose how much they contribute and invest.

The union’s contribution is another factor in the average union plumber’s pension. Depending on the labor agreement, the union may provide additional contribution funds or other incentives to ensure that union plumbers can receive the maximum benefit from their pension plan.

Finally, the number of years that a union plumber has worked will also affect their pension. Generally, the longer a worker is employed by the union, the more money they will receive upon retirement.

Understanding these factors and how they can influence the average union plumber’s pension can help union plumbers plan for their retirement and ensure that they are making the most of their pension benefits.

Strategies for Maximizing Retirement Benefits

For union plumbers, retirement planning can be a complex and daunting task. After all, the average union plumber pension is far from trivial and requires careful consideration and planning to ensure the best possible outcome. To maximize retirement benefits, union plumbers must understand their pension plans and develop a strategy for their future.

The first step is to understand the types of benefits available. Many union plumbers are eligible for defined benefit plans, which provide a regular income stream for life. Additionally, union plumbers may qualify for defined contribution plans, which allow them to save funds for retirement. It’s important to understand the differences between these two types of plans, as they will affect the amount of money received in retirement.

Next, union plumbers should consider their current and future financial situation. This includes estimating the future cost of living and determining how much they will need to save to cover expenses. Additionally, it’s important to factor in the tax implications of retirement. This may include making pre-tax contributions to a retirement account or taking advantage of other tax incentives.

Finally, union plumbers should look into ways to increase their retirement benefits. This could include taking advantage of employer match programs or contributing to an IRA. Additionally, union plumbers may want to consider investing in the stock market or other investments to further grow their retirement nest egg.

By understanding their pension plans and developing a retirement strategy, union plumbers can maximize their retirement benefits and ensure a comfortable lifestyle in their golden years. With the right planning and preparation, union plumbers can enjoy a secure and comfortable retirement.

Investment Options for Union Plumbers

Union plumbers are among the most reliable and hardworking individuals in the trades industry. They have established a long-term career that is respected and admired by many. As a result, union plumbers have the opportunity to invest in their future with a pension plan. The average union plumber pension is an important retirement benefit that can be used to fund a comfortable retirement.

When it comes to investment options for union plumbers, there are plenty of options to choose from. Union plumbers can invest in stocks, bonds, mutual funds, and exchange-traded funds. They can also consider investing in real estate, annuities, and life insurance products. Additionally, union plumbers can opt-in to additional pension plans offered by their employers, such as 401(k) and 403(b) plans.

Union plumbers need to understand the different investment options available to them and how to best maximize their retirement savings. Investing in the stock market can be risky, so union plumbers should consult with a financial advisor to ensure that their investments are properly diversified. Additionally, they should be aware of the fees associated with different investment products, as these can significantly reduce the return on their investments.

Union plumbers should also consider the tax implications of their investments and make sure that their pension plan is designed to provide them with the most tax-efficient retirement savings possible. With the right mix of investments, union plumbers can ensure that their pension plan will provide them with the necessary income for a comfortable retirement.

Retirement Planning Support for Union Plumbers

Union plumbers have worked hard to earn a living and provide for their families. As such, they deserve to enjoy a secure and comfortable retirement. However, many union plumbers are not aware of the pension plans and retirement options available to them. This blog post is intended to provide union plumbers with the information they need to make informed decisions about their retirement planning and pension needs.

We’ll discuss the average union plumber’s pension, the benefits of joining a union pension plan, and the importance of planning for retirement. We’ll also offer tips on how to maximize your retirement income by investing and saving and provide resources to help union plumbers make the most of their retirement years.

By understanding the average union plumber’s pension, the benefits of joining a union pension plan, and the importance of planning for retirement, union plumbers can ensure that they will have the financial security they need to enjoy a comfortable retirement. Additionally, with the right resources and guidance, union plumbers can make the most of their retirement years and secure a better future for themselves and their families.

FAQs About the Average Union Plumber Pension

1. How much does an average union plumber’s pension pay out?

The amount of an average union plumber’s pension varies depending on the specific union and the individual’s years of service. Generally, pensions range from $1,500 to $3,500 per month.

2. How long does it take to qualify for a union plumber pension?

In the United States, union plumbers typically need to work for a union-affiliated employer for 10 years to qualify for a pension.

3. What are the eligibility criteria for receiving a union plumber pension?

Eligibility criteria vary depending on the specific union and the individual’s years of service. Generally, to receive a union plumber pension, a plumber must have at least 10 years of service with a union-affiliated employer and must be at least 55 years of age.

Conclusion

The average union plumber’s pension is an essential part of retirement savings for those in the plumbing industry. It provides stability and security to those who have dedicated their lives to their work, and it offers peace of mind that they will be able to live comfortably in retirement. Although the amount of money in a union plumber pension varies depending on the individual’s service and contributions, it is generally enough to provide a comfortable retirement.